The Kelly Criterion is the brilliant summation of a betting strategy first discovered by Information Theorist John Kelly. Kelly came up with a betting system which optimizes bankroll growth based upon known odds and a definite payout. If you can find an exploitable, repeatable edge, Kelly's system tells the maximum you should bet based upon that criteria.

- Kelly Criterion Keywords=kelly Criterion

- Kelly Criterion

- Kelly Criterion Calculator

- Kelly Criterion Example

Kelly Criterion Optimal Asset Allocation Calculator

Here's a calculator which applies the concepts in this post to come up with an allocation:

The Kelly Criterion helps you calculate the optimal amount you should wager when there is a difference between the true odds and the given odds. A mathematician called John Kelly Jr.

Using the Kelly Criterion with Your Portfolio

The Kelly Criterion was first introduced by J.L. Kelly who was a researcher for Bell Labs in 1956. The idea behind the theorem is to maximize wealth as the number of observations (or bets) goes to infinity. Though originally created for financial portfolios, it has been borrowed by the sports betting community for bet size management. The Kelly Criterion. If you read through our betting guide, you would know that the Kelly Criterion is a staking plan that recommends a bet size by comparing the probability of an outcome as rated by you and, the odds provided by the betting agency. The Kelly Criterion is a method by which you can used your assessed probability of an event occurring in conjunction with the odds for the event and your bankroll, to work out how much to wager on the event to maximise your value. By inputting the odds, the probability of the event occurring and your betting balance, you will be able to determine the amount you should wager on the event.

Extending Kelly a bit further (like Ed Thorp, author of two math bibles for the investor/bettor Beat the Dealer and Beat the Market, has done) we can do a bit of hand-waving and make it work for the stock market.

Some derivations of 'Stock Market Kelly' involve using back-looking numbers such beta to approximate the continuous returns of securities. We're going to do it in a discrete way, and use discrete numbers for wins and losses.

The Kelly Criterion For Asset Allocation

Let's say that you're investing with a 10 year time-frame – you want to buy a house or retire, for example. You have an extra $100,000 and are trying to determine the best allocating between stocks and treasury bonds.

Let's try to calculate is your 'edge' and your 'odds'.

It's true: garbage in, garbage out. All we can do is take an educated guess and hope that it is close enough to reality to guide our choices. (See: past performance is no guarantee of future results.)

As they say, history doesn't repeat itself but it often rhymes.

Odds: The S&P 500 beats 10 Year Treasuries roughly 85% of the time over rolling 10 year periods. We'll then enter .85 for our odds of stock out-performance.

Kelly Criterion Keywords=kelly Criterion

Extending Kelly a bit further (like Ed Thorp, author of two math bibles for the investor/bettor Beat the Dealer and Beat the Market, has done) we can do a bit of hand-waving and make it work for the stock market.

Some derivations of 'Stock Market Kelly' involve using back-looking numbers such beta to approximate the continuous returns of securities. We're going to do it in a discrete way, and use discrete numbers for wins and losses.

The Kelly Criterion For Asset Allocation

Let's say that you're investing with a 10 year time-frame – you want to buy a house or retire, for example. You have an extra $100,000 and are trying to determine the best allocating between stocks and treasury bonds.

Let's try to calculate is your 'edge' and your 'odds'.

It's true: garbage in, garbage out. All we can do is take an educated guess and hope that it is close enough to reality to guide our choices. (See: past performance is no guarantee of future results.)

As they say, history doesn't repeat itself but it often rhymes.

Odds: The S&P 500 beats 10 Year Treasuries roughly 85% of the time over rolling 10 year periods. We'll then enter .85 for our odds of stock out-performance.

Kelly Criterion Keywords=kelly Criterion

Edge: Edge is tough, but for arguments sake, let's use 5%.

Kelly Criterion

Historically 5% is a decent choice; sometimes authors will take average earnings yield and subtract Treasury yield. Biggest online bingo sites for real. Change it as you desire.

Using Odds and Edge to Optimize Asset Allocation

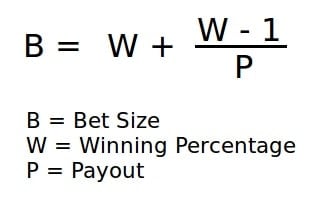

Texas holdem cash game tactics. 'Normal' or 'Full' Kelly is

We need to modify the Kelly Criterion a bit to take into effect the fact that generally a security won't 'go to zero'. (Even a losing 'bet' almost always has some value in the stock market).

We simplify the equation to

Here's the math using the assumptions in the previous section:

Kelly Criterion Calculator

So, in this theoretical portfolio with your historic estimate of odds and edge, aim for 79% stocks and 21% bonds. The standard disclaimer applies: these numbers are guesses, so adjust your expectations accordingly.

Kelly Criterion Example

How to win on online casinos. For traditional Kelly applications, also try the Kelly Calculator for bet sizing.